How stadia will adapt to the changing way that we consume football

Meeting the challenge of delivering a holistic service and brand experience that satisfies modern fans.

The way that we consume football continues to evolve. Long gone are the days when clubs relied on loyal fans passing through the turnstiles as a primary source of income. This revenue stream was already in decline when the UK’s Premier League began in 1992.

The brand of top-flight domestic football was rapidly transformed by this elite breakaway division. However, it takes more than just rebadging a competition to create sustainable success. For example, the 1996 formation of rugby league’s Super League largely offered fans the same players turning out for the same teams at the same antiquated grounds. British football, though, was already undergoing wholesale metamorphosis when the TV money arrived.

“Football spectators are invited by the clubs for entertainment and enjoyment. Often, however, the facilities provided for them have been lamentable.” This was one of many unfavourable observations contained within Lord Justice Taylor’s final report (1990), an inquiry into football ground safety prompted by the 1989 Hillsborough disaster. In what he described as a “dismal account of the football scene”, Taylor’s wide-ranging assessment took in the entire fan experience: apart from safety concerns, he also noted such shortcomings as a lack of pre-match entertainment and refreshments “of indifferent quality”. Most significantly was Taylor’s recommendation that grounds become all-seater, which the government not only accepted but also part-funded via multi-million pound grants from the Football Trust. The influx of wealth produced by the burgeoning Premier League expedited this obligatory regeneration of stadia stock and reshaped the matchday experience.

Most clubs had been severely constrained in their ability to monetise assets due to poor stadium quality.

Most clubs had been severely constrained in their ability to monetise assets due to poor stadium quality. Because the day’s entertainment began and ended on the pitch, people turned up for the game and then went home. All-seater stadia changed this situation just as club owners realised that only when not watching the game were fans at liberty to spend money. Accordingly, there was a proliferation of club shops, more food and beverage concourses, and premium corporate hospitality. Even away from the terraces, the old grounds were not always welcoming places for women and children. These new stadia were family-friendly venues, which could compete with the allure of multiplex cinemas that had sprung up throughout the latter half of the 80s.

Unsurprisingly, given Sky’s contribution, fans were soon able to watch sophisticated television coverage of a huge number of games. Increasingly affordable home cinema systems made catching the action at home an enticing option. For added companionable atmosphere, there was always the enormo-screen at the local pub. Clubs responded by creating their own media outlets, introducing fan zones and looking to stage events – rather than just matches – at their venues.

Through subsequent years, the explosion of social media transformed fan engagement. People could choose what they saw – either on television or live – then share it with friends through selfies and location tagging. Fans now interact with their clubs in completely different ways from even just a few years ago. Due to this shift in consumption, there is likely to be a revolution in media rights income. Clubs must adapt and diversify their revenue or see a decline in their ability to compete both on and off the pitch.

In stressing the necessity for clubs to remain aware and versatile, it is pertinent to reiterate just how rapidly the Premier League developed as a global entity. Far from being a showcase for the world’s finest talent, the division featured 13 overseas players on its opening day. Seven years later, facing Southampton away on Boxing Day 1999, Chelsea became the first British team to field an all-foreign starting XI. The money, too, has moved on. That crucial first TV package, which spanned five years, was sold for £304m. The most recent UK rights deal, covering live games for 2019-2022, is worth £4.64bn. Dozens of international broadcast contracts add well over £1bn per year.

The fan experience of football stadia has changed a lot since the 1980s, particularly in terms of seating area quality for general admission fans and the proliferation of high-end products to buy. However, in terms of a holistic experience outside and inside the stadia, it is much less refined when compared to what is on offer elsewhere in the entertainment and retail sectors. This creates both a challenge and an opportunity for football clubs, particularly when viewed in the context of shifting demographics, behaviours and expectations.

Successful venues deliver a rich, rewarding and memorable experience for visitors along with the best possible business return for the needs of stakeholders.

Successful venues deliver a rich, rewarding and memorable experience for visitors along with the best possible business return for the needs of stakeholders. These are the sought-after “destination venues”. In successfully creating such venues, an intelligently realised servicescape – the total environment in which interaction between customer and service provider takes place – is critical.

The sports venue servicescape begins at line of sight with its visitors. Once inside, all stakeholders are represented along with food and beverage (F&B), retail, and all parts of the event day, which includes the main attraction. This offers the most significant and intense volume of emotional and financial transactions with brands, F&B and merchandise.

The optimisation of the servicescape’s performance has a direct and quantifiable relationship with the interests of all stakeholders, as well as the visitors. There are four essential considerations that are boosted by optimising the servicescape: dwell time, digital impressions, revenue and the destination venue. Key to all of these considerations is venue flexibility – static and dynamic – that caters to different types of visitor expectations. This drives up customer satisfaction and enhances feeling and experience. The result is higher expenditure and heightened affiliation.

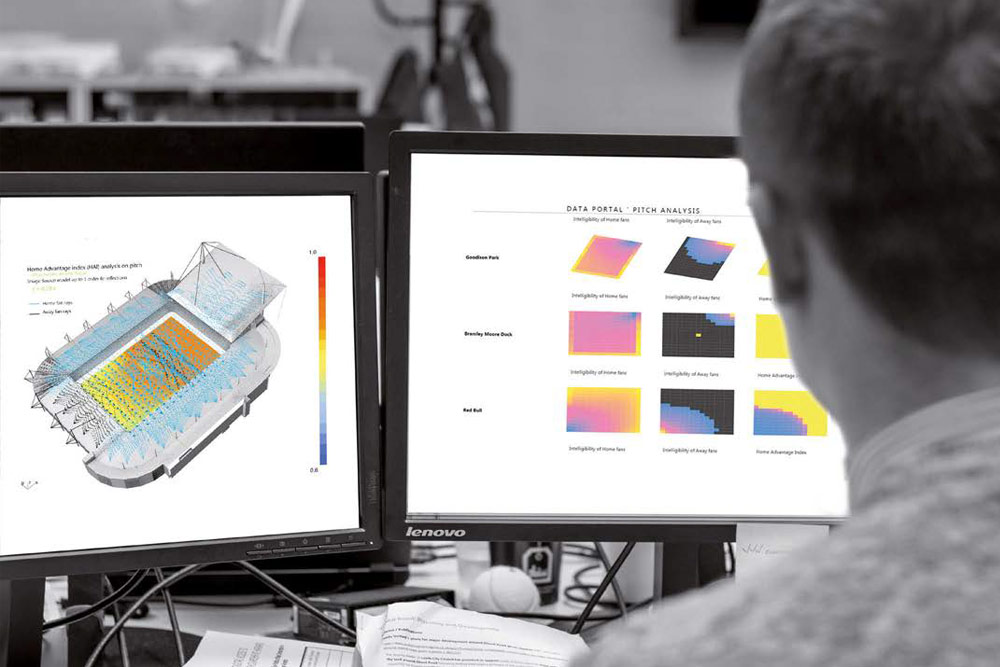

A lot is written about the stadium of the future, much of it fanciful and playful rather than realistic. What appears certain, however, is that stadia design and operation will be driven by a business imperative. The aim will be to optimise the built environment in appealing to consumers’ cognitive, emotional and physiological senses during every interaction with the venue.

The business benefits of adopting this approach in terms of naming rights, sponsorship, retail and digital revenue generation are substantial. Consequently, we foresee that soon the commercial partners of our football clubs will be steering design and operation of the venues that they are putting their names to.

As the way that we consume football evolves and matchday expectations change, we will be creating destinations rather than just stadia. These will be places that people want to spend time in, where they can take part in multiple activities, enjoy quality entertainment and look forward to visiting again and again.